EBRD adopts strategy for Greece

The Board of Directors of the European Bank for Reconstruction and Development (EBRD) has adopted a strategy for Greece, which sets out the Bank’s priorities for its investment activities in the country. The EBRD started to invest in Greece in 2015 on the basis of a temporary mandate until the end of 2020.

The EBRD country strategy for Greece identifies the following key areas:

– Support the success of private Greek companies and help them realise their export potential. Greek firms, many of which are small and medium-sized enterprises (SMEs), have been hit hard by the country’s economic downturn. As structural reforms and restructuring are beginning to take hold, the EBRD will support the revival of economic growth by providing funds to companies with growth and export potential.

– Support the stabilisation of the financial sector. Access to finance remains one of the most significant concerns for Greek businesses and the banking sector continues to grapple with significant levels of non-performing loans (NPLs). The EBRD will offer a full range of financing products including trade finance as well as finance for SMEs and energy efficiency credit lines as well as targeted finance facilities. Additional support will come through investments in NPL platforms. The Bank will also contribute to improving corporate governance in the banking sector and the deepening of financial intermediation for the real economy, particularly through capital markets.

– Support private sector participation in and commercialisation of the energy and infrastructure sectors. Greece’s potential for regional integration can be unlocked through infrastructure and energy privatisation and the commercialisation of public utilities. This will allow Greece and its neighbours to deepen their trade and infrastructure linkages and contribute to regional energy integration. The Bank will specifically support transactions which lead to improved quality of public services, increased competition and regional integration.

One of the EBRD’s first interventions in Greece last year was the participation in the recapitalisation of the country’s four systemic banks. This transaction was crucial for the stabilisation of the country’s financial sector and represented an important step towards allowing it to resume its lending role for the wider economy. In addition, among other investments, the EBRD has provided capital to a private equity fund, acquired a stake in an insurance company and provided trade finance guarantees. New projects are under development.

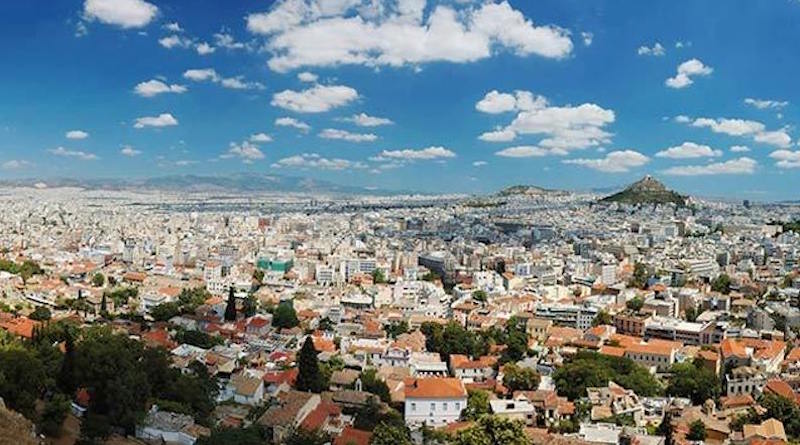

Photo: EBRD.com